V. THE ECONOMIC CONSEQUENCES OF LIBERTY

Introduction

I should call this part "The Benefits of Liberty That Can Be Measured in Dollars, and How They Have Been Reduced Dramatically by the Regulatory-Welfare State" or "The Price of Privilege." To recap what I said in Part II:

The core of libertarianism is liberty: briefly, the negative right to be left alone -- in one's person, pursuits, and property -- as long as one leaves others alone. I am using "liberty" here to encompass what the Founders intended by "life, liberty, and the pursuit of happiness" in the Declaration of Independence....This is that later part. I will assess here the economic benefits of liberty by estimating how much better off Americans would be if their liberty hadn't been curtailed progressively (pun intended) over the past 100 years.

A privilege, by contrast to liberty, is a positive right, that is, a grant of special (unequal) treatment....

Law-made privileges result in the direct and indirect redistribution of income and wealth through welfare and regulation. We tend to think of welfare as a subsidy or other special treatment based on age, gender, race, level of income, infirmity, or other condition of being. Welfare also includes unequal taxation; e.g., progressive taxation of personal income, a city's granting of tax breaks to entice a business to locate there.

Regulatory privileges are accorded by specifying the conditions of economic activity for the purpose of promoting certain outcomes (e.g., "protecting" domestic manufacturers from foreign competition) and proscribing other outcomes (e.g., prohibiting the sale of certain types of drugs before they undergo a lengthy approval process). Regulation in the name of "protecting the public" is really a privilege because it (a) is accomplished by an elite group, (b) usually provides psychic satisfaction for a group of do-gooders, and (c) often does not protect the public. (The most egregious example of spurious protection of the public is the Food and Drug Administration's lengthy process for the approval of new drugs, which does more harm than good.)

Privilege therefore differs fundamentally from liberty in that it attempts to make some persons better off through the compulsion of others persons, with the result that it usually makes almost everyone worse off. (I will have more to say about the effects of the welfare-regulatory regime in a later part of this essay.)

The logical incompatibility of liberty rights and privileges doesn't keep most people from wanting both. People want to be left alone, but it seems that almost everyone also yearns for some version of the welfare-regulatory state. (See Part III.) People seem to believe that government -- through taxation and regulation -- does things that are more valuable than the freedom of action they forego because of taxation and regulation. Most Americans simply don't understand the true costs and illusory benefits of the welfare-regulatory state.

Americans' economic illiteracy has been exploited by equally ignorant "public intellectuals" and cynical demagogues who have dominated political discourse and politics since the accidental and unfortunate elevation of Theodore Roosevelt to the presidency. (I include not only Democrats among those cynical demagogues but also the many Republicans who have abandoned the party's long commitment to limited government for the sake of holding onto power.)

When Americans and their "public servants" clamor for privileges they undo the work of liberty because privileges impose a heavy economic burden on almost everyone -- including their intended beneficiaries. Why? Because, privileges depend on taxation or regulation for their effect, thus blunting economic incentives and diverting resources to less-productive and unproductive uses.

Absent the welfare-regulatory state, most of the poor would be rich, by today's standards. And those who remain relatively poor or otherwise incapable of meeting their own needs -- because of age, infirmity, and so on -- would reap voluntary charity from their affluent compatriots.

The Cumulative Cost of Government Intervention

The cumulative cost of government intervention can be approximated by analyzing trends in Gross Domestic Product. GDP has its limitations as a measure of happiness, because happiness -- or personal satisfaction or self-interest, if you prefer -- cannot be aggregated, nor can it measured entirely in dollars:

- Not everything that makes us happy is included in GDP. A compelling if brief list of exclusions: early retirement, having children, parenting one's own children in lieu of paid employment, fresh air and unspoiled scenery, tranquility, and freedom from worry about crime. In fact, large numbers of Americans forgo income (which is captured in GDP) for the sake of such things as having children (the enjoyment of which isn't included in GDP).

- Not everything that's for sale is included in GDP (e.g., illegal transactions and barter).

- GDP captures many things of negative value (e.g., the cost of government programs that restrict freedom of choice; the cost of cleaning up pollution; and the amounts of money we spend on crime, traveling on congested highways, and trying briefly to escape the daily grind of urban living).

Because estimates of GDP don't capture the value of child-rearing and other aspects of "household production" by stay-at-home mothers, the best way to put 1900 and 2000 on the same footing is to estimate GDP for 2000 at the labor-force participation rates of 1900. The picture then looks quite different: real [inflation-adjusted] GDP per capita of $4,300 in 1900, real GDP per capita of $25,300 in 2000 (a reduction of 28 percent), and an annualized growth rate of 1.8 percent, rather than 2.1 percent.I went on to say:

The twentieth century was a time of great material progress. And we know that there would have been significantly greater progress had the hand of government not been laid so heavily on the economy. But what we don't know is the immeasurable price we have paid -- and will pay -- for the exodus of mothers from the home. We can only name that price: greater incivility, mistrust, fear, property loss, injury, and death.Money can buy happiness, but GDP has become an increasingly unreliable proxy for happiness because of the unavoidable -- and often undesirable -- correlates of economic growth, namely, population growth and social change. Nevertheless, as I will show, the net effect of government intervention has been to reduce the aspect of happiness that is represented by GDP. We have paid a steep price for such interventions as these:

- direct spending on government operations and capital acquisitions

- disincentives to work, innovate, and invest arising from taxation (especially taxes on income, and more especially progressive taxes on income)

- disincentives to work and save arising from social programs and transfer payments (including, but certainly not limited to Social Security, Medicare, and Medicaid)

- diminution of competition and efficiency through myriad laws and regulations that hamper the design, production, and sale of goods and services ranging from aspirin to yogurt

- restrictions on voluntary exchange (e.g., minimum wage laws, compulsory recognition of labor unions, and imposition of tariffs).

- the cost of government purchases of goods and services for current operations and capital (buildings and equipment)

- the value of government transfer payments, which take money from those who produce and give it to those who don't produce (as in the case of Social Security, Medicare, and Medicaid)

- the amount by which social and economic regulations reduce the level of economic output.

But that estimate measures only the heavy hand that government lays on current economic output. It doesn't measure the cumulative effect that government intervention has had on economic activity. Actions by government that discourage or diminish work, saving, investment, competition, efficiency, and voluntary exchange have irretrievable, long-term, negative effects on economic output. Economic opportunities, once forgone, cannot be recovered; they compound, like negative interest.

Consider, for example, a capital investment that isn't made because of high taxation or oppressive regulation. The return on that investment would have produced income that would have funded other investments, which would have produced yet more income that would have funded yet more investments, and on and on, in a reverse accelerator effect. There's an analogous effect whenever current economic output is reduced because of a government action that discourages or distorts incentives to work, save, invest, innovate, compete, improve efficiency, or enter into a voluntary economic exchange.

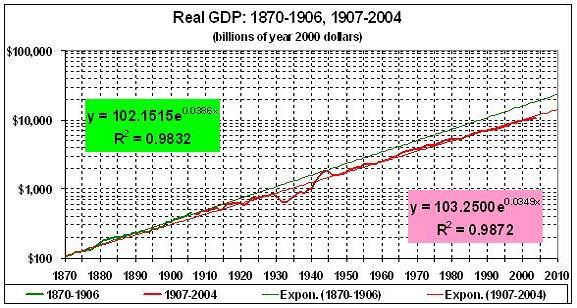

And that's what has happened in America. Real (inflation-adjusted) GDP began to rise sharply after the Civil War, thanks mainly to the Second Industrial Revolution. Despite the occasional slump -- which the economy worked its way out of, thank you -- things continued to go well until about 1906. Then the trajectory of GDP growth fell suddenly, sharply, and (it seems) permanently. The Panic of 1907 coincided with, but did not cause, the deceleration of America's economy.

Data on real GDP for 1870-2003 are from Louis Johnston and Samuel H. Williamson, "The Annual Real and Nominal GDP for the United States, 1789 - Present." Economic History Services, March 2004, URL: http://www.eh.net/hmit/gdp/. Real GDP for 2004 estimated by deflating nominal 2004 GDP (source at footnote a) by increase in CPI between 2000 and 2004 (from Bureau of Labor Statistics).

The stock market -- an accurate, if volatile, indicator of the nation's economic health -- corroborates my judgment about the downward shift in economic growth. After 1906 the S&P 500 (as reconstructed back to 1870) dropped to a new trendline that has a shallower slope and an intercept that is 48 percent lower than that of the trendline for 1870-1906.

Real S&P price index constructed from annual closing prices of the S&P 500 Composite Index (series "S&P 500® Composite Price Index (w/GFD extension)"), available at Global Financial Data, Inc., and the GDP deflator (see notes for previous chart).

What happened around 1906? First, the regulatory state began to encroach on American industry with the passage of the Food and Drug Act and the vindictive application of the Sherman Antitrust Act, beginning with Standard Oil (the Microsoft of its day). There followed the ratification of the Sixteenth Amendment (enabling the federal government to tax incomes); the passage of the Clayton Antitrust Act (a more draconian version of the Sherman Act, which also set the stage for unionism); World War I (a high-taxing, big-spending, economic-control operation that whet the appetite of future New Dealers); a respite (the boom of the 1920s, which was owed to the Harding-Coolidge laissez-faire policy toward the economy); and the Great Depression and World War II (truly tragic events that imbued in the nation a false belief in the efficacy of the big-spending, high-taxing, regulating, welfare state).

The stock-market debacle of 1916-20 was as bad as the crash of 1929-33 (see second chart above), and the ensuing recession of 1920-21 was "sharp and deep," as the unemployment rate rose to 12 percent in 1921. But Americans and American politicians didn't panic and scramble to "fix" the economy by adopting one perverse scheme after another. Thus prosperity ensued.

But less than 10 years later -- at the onset of the Great Depression -- Americans and American politicians lost their bearings and joined Germany, Italy, and Russia on the road to serfdom. Most Americans still believe that government intervention brought us out of the Depression. That bit of shopworn conventional wisdom has been debunked thoroughly by Jim Powell, in FDR's Folly: How Roosevelt and His New Deal Prolonged the Great Depression, and Murray N. Rothbard, in America's Great Depression. The bottom line of FDR's Folly is stark:

The Great Depression was a government failure, brought on principally by Federal Reserve policies that abruptly cut the money supply; unit banking laws that made thousands of banks more vulnerable to failure; Hoover's tariff's, which throttled trade; Hoover's taxes, which took unprecedented amounts of money out of people's pockets at the worst possible time; and Hoover's other policies, which made it more difficult for the economy to recover. High unemployment lasted as long as it did because of all the New Deal policies that took more money out of people's pockets, disrupted the money supply, restricted production, harassed employers, destroyed jobs, discouraged investment, and subverted economic liberty needed for sustained business recovery [p. 167].(Also see this.) All we got out of the New Deal was an addiction to government intervention, as people were taught to fear the free market and to believe, perversely, that government intervention led to economic salvation. The inculcation of those attitudes set the stage for the vast regulatory-welfare state that has arisen in the United States since World War II. (See footnote c.)

You know the rest of the story: Spend, tax, redistribute, regulate, elect, spend, tax, redistribute, regulate, elect, ad infinitum. We became locked into the welfare state in the 1970s (see the chart at footnote a), and the regulatory burden on Americans is huge and growing. The payoff:

- Real GDP (in year 2000 dollars) was about $10.7 trillion in 2004.

- If government had grown no more meddlesome after 1906, real GDP might have been $18.7 trillion (see first chart above).

- That is, real GDP per American would have been about $63,000 (in year 2000 dollars) instead of $36,000.

- That's a deadweight loss to the average American of more than 40 percent of the income he or she might have enjoyed, absent the regulatory-welfare state.

- That loss is in addition to the 40-50 percent of current output which government drains from the productive sectors of the economy.

Wrong, wrong, wrong! The sum of human happiness -- or that part of it which can be measured in dollars -- has been diminished drastically and permanently by the corrosive action of TR's Square Deal, FDR's New Deal, HST's Fair Deal, LBJ's Great Society, and the other statist agendas of the past 100 years.

Lesson Learned?

Unless Americans become aware of the extremely high and largely hidden cost of the regulatory-welfare state, they will remain addicted to it. For reliance on government is an addictive drug -- and a very expensive one. We swallow each dose in the hope that it will make us secure, and when that dose doesn't make us secure we swallow another dose, in the hope that that dose will make us secure. And on and on. In the end, we are left with nothing but a costly addiction to government that impairs our liberty therefore ruins our economic health.

What Americans have failed to understand, is that there is less risk of coming to harm in a free-market economy -- where individuals have an incentive to take care of themselves -- than there is of coming to harm in the regulatory-welfare state. (See my series of posts on "Fear of the Free Market," in three parts; my post on "Free Market Healthcare"; and my post on "Why Class Warfare Is Bad for Everyone.") Free people do not stay mired in poverty and tend not to repeat their mistakes, if they are allowed to learn from those mistakes. (See my posts about income inequality.) As Arnold Kling says:

Ultimately, it is people who make decisions in markets and in government. People are fallible in both settings. The difference is that in a market setting mistakes are corrected more quickly than in a government setting. Thus, even if markets were wrong nine times out of 10 and government were right nine times out of 10, over time markets would achieve better outcomes.But Kling is too generous to government, the imperative of which is aggrandizement, not self-betterment. Government isn't the people and cannot replicate what people would do if they were allowed to do it for themselves. (See these excerpts of Hayek's writings and my post on "Socialist Calculation and the Turing Test.") Michael Munger says it well:

Bureaucracy can not be improved, because its very nature is incompatible with a society of free citizens who take responsibility for their own lives and their own choices. The incentives and hierarchies in the two forms are fundamentally different.To put it most starkly, citizens may say, and believe, that the problem is unresponsive bureaucracy, or corruption, but these are the essential features of the governments of large nations. The solution is a citizenry that understands the economic and political forces that make government inherently incapable of carrying out the tasks we want to assign to it. But the mainstream media, nearly entirely innocent of knowledge of basic economic principles, has no hope of aiding such an understanding, and more often than not contribute to the "we can do better" mindset by carrying sensational stories of corruption inevitably followed by demands for reform.

Economics can be as abstruse as the physics of special relativity. But it rests on two things that are easily learned:

• Incentives matter.When people are deprived of incentives through taxation, regulation, and welfare, they are less able and willing to strive for themselves. And it is self-striving that leads people to do things that are valued by others. Regulation and welfare (the "free lunch") impose costs (bureaucratic overhead), where there otherwise would be no costs, and distort the free-market signals that tell people how they can do better for themselves by doing better for others.

• There’s no such thing as a free lunch.

Quo Vadimus?

Will Americans learn that incentives matter and that there is no free lunch? The battle over Social Security will tell the tale. If partial privatization succeeds, perhaps something close to full privatization might follow. After that, anything is possible: the end of Medicare and more vigorous deregulation, for example.

Help may be on the way. America -- in spite of the past 100 years of creeping and galloping statism -- may be on the verge of rapid economic growth. (See this, this, and this.) A sustained burst of growth would obviate the felt need for many facets of the regulatory-welfare state: When times are bad people turn to government for succor; when times are good, people have more confidence in their ability to take care of themselves.

Whether a new era of rapid growth materializes will depend greatly on our ability to retain our collective sanity in the face of environmental hysteria. (Go here and follow the links. See this, also.) There are market solutions (e.g., nuclear power and clean coal), but their implementation will be resisted by contemporary "Bootleggers and Baptists." ("Bootleggers" are market incumbents -- as represented by the American Medical Association and the American Bar Association, for example -- who benefit from the suppression of competition, as did bootleggers during Prohibition. "Baptists" are self-appointed guardians of our health and well-being -- the sum of all our risk-averse fears, you might say.)

The next several years will see a showdown between the forces of darkness and the forces of progress in America. The forces of darkness -- having already greatly diminished the general welfare in the name of improving it -- will seek to tighten the shackles of the regulatory-welfare state in the name of environmentalism. The forces of progress will seek to tame the regulatory-welfare state -- if not repeal it. But they will be labeled evil, greedy, know-nothings for trying to protect us generally from the predations of the welfare-regulatory state and particularly from the ravages of environmental hysteria. As Ludwig von Mises put it:

[I]f a revolution in public opinion could once more give capitalism free rein, the world will be able gradually to raise itself from the condition into which the policies of the combined anticapitalist factions have plunged it.14 [Quoted by Bryan Caplan.]I am doubtful of a revolution in public opinion, especially because it would require a revolution in elite opinion and in the media -- both of which are in thrall to the god of the regulatory-welfare state.

As I will argue in Part VI, we have come to our present state because public opinion, elite opinion, and the media have combined to undo the great work of the Framers, whose Constitution prevented tyranny by the majority. Unchecked democracy has become the enemy of liberty and, therefore, of material progress. As Michael Munger says, "The real key to freedom is to secure people from tyranny by the majority, or freedom from democracy."

The last best hope for liberty and prosperity lies in the neutralization of public opinion through a renewal of constitutional principles. I'll have more to say about that in Parts VII and VIII.

__________

a. In 1929 and earlier, government spending and transfer payments hovered around 10 percent of GDP in peacetime. Defense spending always has fluctuated in response to threats from abroad. But other government outlays -- especially transfer payments -- have risen steadily since the end of World War II; they now account for more than 25 percent of GDP. Thus the relative burden of governments' nondefense activities (including transfer payments) on the productive sectors of the economy is now about 2.5 times as great as it was before the Great Depression. In absolute terms, of course, the burden of government spending is astronomically higher than it was in 1929.

Percentages are derived from U.S. Department of Commerce, Bureau of Economic Analysis, National Income and Product Accounts, Table 1.1.5: Gross Domestic Product (data for 1929-2004), line 1 (Gross domestic product), lines 22 and 23 (Federal defense and nondefense expenditures), and line 24 (State and local expenditures); and Table 3.1: Government Current Receipts and Expenditures (data for 1929-2004), line 17 (Current transfer payments).

b. An official estimate of the annual benefits flowing from federal regulations places the value of those benefits at less than $200 billion. But the annual cost of those regulations -- including the hidden costs not included in the government estimate -- is approaching or has exceeded $1 trillion, as discussed here, here, here, and here.

c. There have been so many instances of government failure in the last 60 years that I won't even try to sample them here. Almost everything you'd like to know about how government usually makes things worse through intervention in the affairs of Americans can be found here:

AEI-Brookings Joint Center

Cato Institute, Regulation Magazine

Competitive Enterprise Institute

George Mason University, Mercatus Center